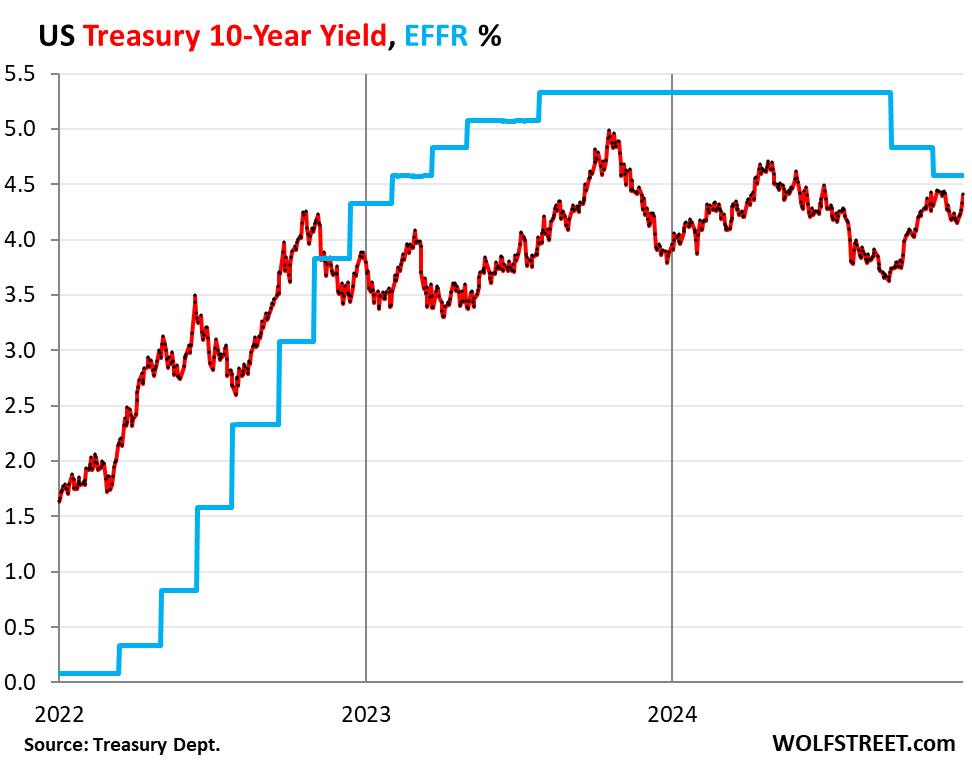

Fed cut by 75 basis points since September while 10-year Treasury yield rose by 75 basis points to 4.40%, as Bond Market frets about Inflation & Supply.

By Wolf Richter for WOLF STREET.

The 10-year Treasury yield jumped by 7 basis points on Friday, to 4.40%, having risen five trading days in a row. It’s now just 4 basis points below the post-rate-cut closing high on November 13 (4.44%). These yields are the highest since June.

Since the eve of the Fed’s September 18 rate cut, the 10-year yield has risen by 75 basis points, while the Fed has cut by 75 basis points. The difference is 150 basis points! The 10-year yield is now higher than all shorter-term yields.

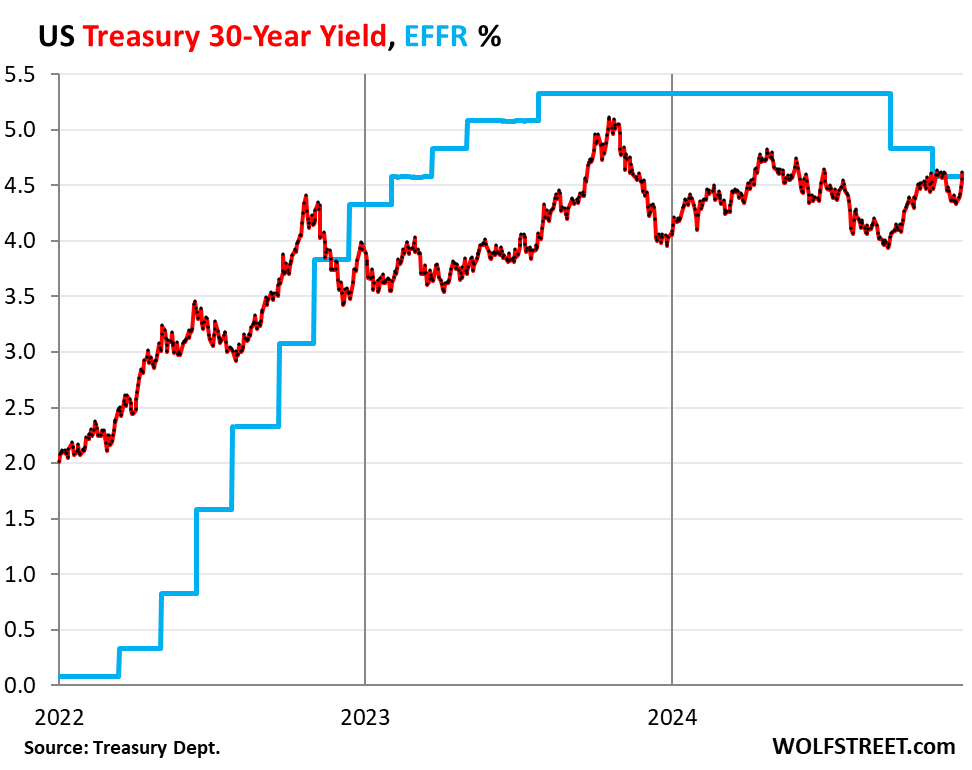

The 30-year Treasury yield jumped by 6 basis points on Friday to 4.61%, now once again above the federal funds rate (4.58%), which the Fed actively brackets with its policy rates. It rose for six trading days in a row and is now just a hair from the November 13 rate-cut high (4.63%). Both of them are the highest since May 2024.

Since the eve of the rate cut on September 18, the 30-year yield has risen by 65 basis points, while the Fed has cut by 75 basis points. Rising bond yields means dropping bond prices.

Among the drivers of higher long-term yields are renewed inflation fears and prospects of a continued tsunami of supply of new debt to finance the massive flow of deficits that the market envisions, even as the Fed is unloading securities through QT and has already shed $2.1 trillion.

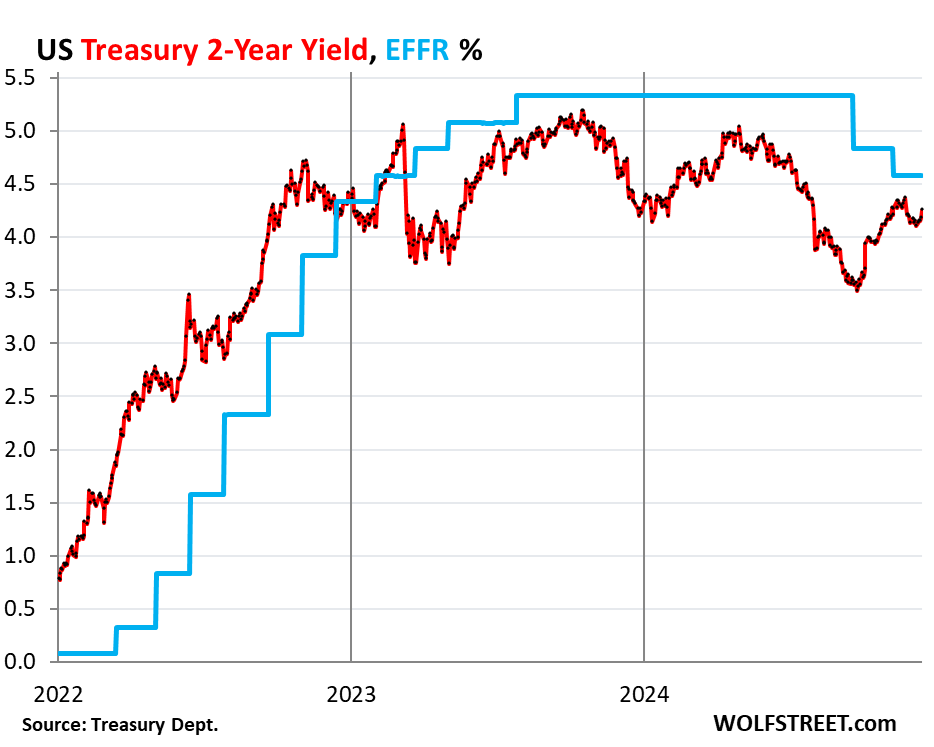

The 2-year Treasury yield jumped by 7 basis points on Friday to 4.25%. Since the eve of the rate cut, it has jumped by 66 basis points.

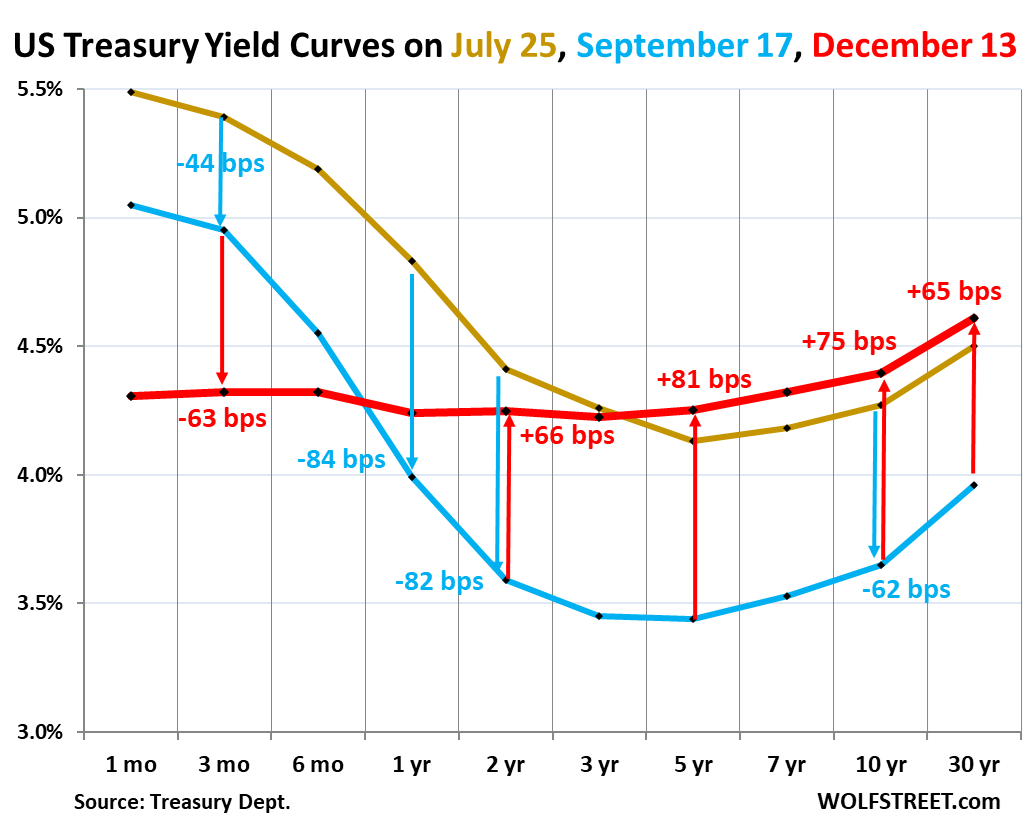

The “yield curve” in the process of un-inverting.

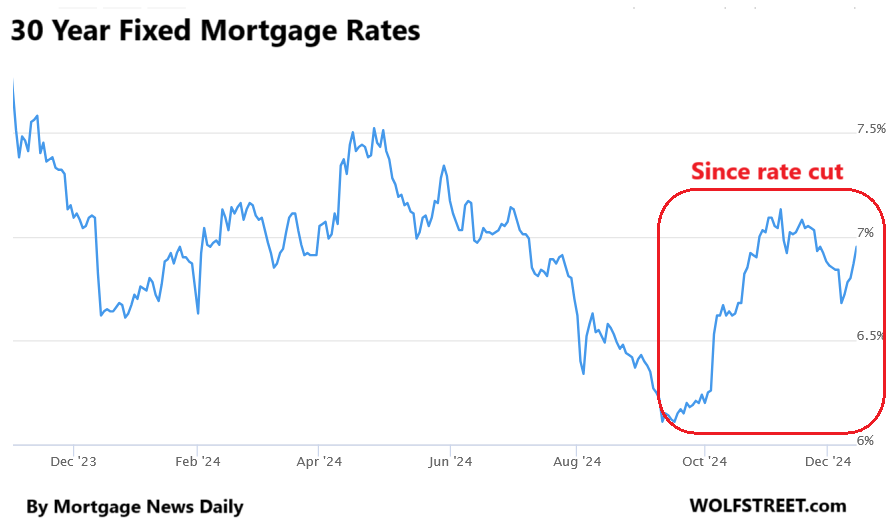

Since the rate cuts started, short-term yields have fallen sharply, and – shock to the real-estate industry – longer-term yields have risen, which pushed mortgage rates higher.

In a normal yield curve, longer-term Treasury yields are higher than short-term yields, with the 1-month and 3-month yields the lowest and with bond yields the highest.

Since July 2022, the yield curve has been “inverted” – with longer-term yields below short-term yields – as the Fed hiked its policy rates, thereby pushing up short-term Treasury yields, while longer-term yields also rose but more slowly, and thereby fell behind.

The yield curve is now in the process of normalizing, but it still hasn’t normalized. In a normal yield curve, the longer-term yields are substantially higher than short-term yields, and they’re now just a little higher. The yield curve will steepen and become more normal with more rate cuts and higher longer-term yields.

The chart below shows the “yield curve” with Treasury yields across the maturity spectrum, from 1 month to 30 years, on three key dates:

- Gold: July 25, 2024, before the labor market data spiraled down (turns out, it was a false alarm).

- Blue: September 17, 2024, the day before the Fed’s rate cuts started.

- Red: Friday, December 13, 2024.

The 10-year and 30-year yields are now higher than the shorter-term yields, and that portion of the yield curve has un-inverted completely.

The 7-year yield (4.32%) is now equal to the 3-month and 6-months yields. And that portion of the yield curve from the 7-year on forward is essentially flat.

Note by how far the longer-term yields have risen since the eve of the rate cuts (blue line), while yields of less than one year have fallen below the blue line.

Mortgage rates have re-risen.

The 30-year fixed mortgage rate roughly parallels the 10-year yield, but is higher, and that spread between them is fairly wide these days due to some factors that we discussed here. A wider spread means relatively higher mortgage rates.

On Friday, the average 30-year fixed mortgage rate rose by 8 basis points to 6.95%, according to the daily measure from Mortgage News Daily.

This U-turn in mortgage rates, after the rate cuts began, was an unpleasant surprise for the housing industry, mortgage bankers, and potential home sellers that are sitting on their vacant homes that they’d moved out of a while ago, but didn’t put on the market because they’d wanted to ride the price spike up all the way.

But with these mortgage rates, and the ridiculously high prices after the 50% surge during the pandemic, demand for existing homes has plunged to the lowest level since 1995, amid surging supply, while homebuilders are now sitting on the largest number of unsold completed homes since 2009 that they need to move pronto — and they’re making deals to do so.

We give you energy news and help invest in energy projects too, click here to learn more

Crude Oil, LNG, Jet Fuel price quote

ENB Top News ENBEnergy DashboardENB PodcastENB Substack

Energy News Beat