- US oil producers are struggling to defend margins at $60 WTI due to additional corporate costs that raise the all-in breakeven price.

- Trade policies and market volatility are threatening US oil production growth, particularly in the Permian Basin, as companies may need to cut back activity to maintain investor payouts.

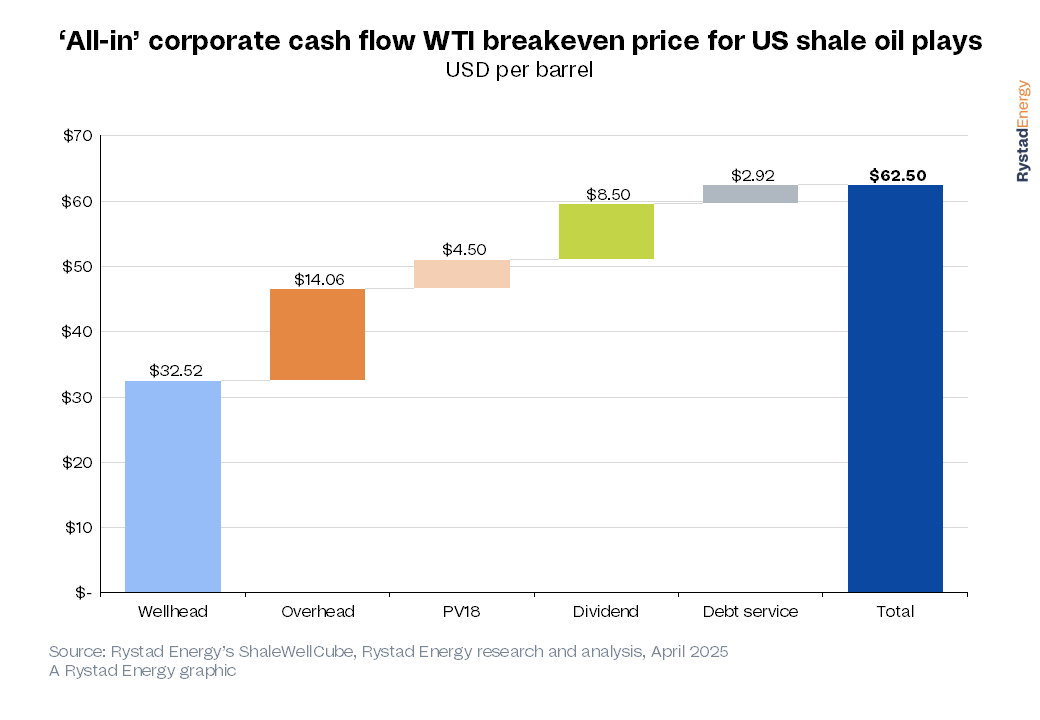

- Increased hurdle rates and debt service costs have pushed the estimated all-in corporate cash flow WTI breakeven to approximately $62.50 for new activity in 2025.

West Texas Intermediate (WTI) crude prices dipped into the low $60 per barrel range following President Donald Trump’s sweeping tariffs announced on 2 April. While the subsequent 9 April move to pause the new levies at 10% for most countries for the next 90 days helped WTI prices recoup some losses, the market remains extremely volatile. This price level is well above the fundamental upstream breakevens for most US shale players, especially those in the Permian. However, Rystad Energy finds that additional corporate items, including higher hurdle rates, dividend payments and debt service costs, means that the “all-in” corporate cash flow breakeven for many US oil players is closer to $62.50 WTI. If the recent price downturn is sustained, these price levels could threaten US oil production growth this year, as operators may be forced to cut back activity to maintain investor payouts.

Sentiment was already fragile following the late March release of the first quarter Dallas Federal Reserve Survey, which found oil and gas executives to be worried about the impact of President Trump’s trade policies. Fresh off of 2025 budgeting, US shale oil players issued guidance indicating another year of modest growth. Nearly all of the US Lower 48 oil growth this year is pegged to come from the Permian Basin. While Permian breakevens are the most commercial in the shale patch, exploration and production (E&P) companies have promised high dividends. At the same time, an uneven distribution of the best remaining acreage means that some of this growth may be at risk if lower prices are sustained.

In the figure below, we estimate the “all-in” corporate cash flow WTI breakeven for a new well in the US oil. E&P executives look beyond these metrics when making investment decisions. ‘Shale 4.0’ has given rise to higher hurdle rates applied to new activity, meaning the historic 10% discount rates have now given way to a much higher returns threshold. We see an 18% discount rate as more realistic for this exercise, which adds another $4.50 per barrel. We find that public players paid $9.30 per barrel of produced oil in dividends in 2024. With some of these dividends variable, we believe that $8.50 per barrel is a realistic figure this year. Lastly, with debt levels rising in recent quarters as operators expand their portfolios through acquisitions, debt service costs rose in 2024. During the year, companies paid $2.92 in interest payments per barrel of net oil production. Added all together, we find that the estimated ‘all-in’ corporate cash flow WTI breakeven is closer to $62.50 for new activity in 2025.

With prices hovering below this level, we see significant risks for US production in 2025. A downshift in the Permian could spell a significantly decelerated pace of growth in 2025, should prices remain subdued. While the Trump administration has sought to both lower prices and increase production, its trade policies have sent prices falling due to the potential for dented demand. The corporate reality for public players means that the already modest growth could be at risk if WTI prices remain in the low $60s. The business model embraced by US oil producers over the past several years becomes far more difficult to maintain with prices below this level. This means that some combination of near-term activity levels, investor payouts or inventory preservation will need to be sacrificed in order to defend margins. While different companies have different sensitivities to the above factors, activity and production will be threatened the most.

Energy News Beat