Spot rates for LNG carriers are now at all-time lows, although some analysts believe the shipping sector is close to bottoming out.

Citing an “overwhelming oversupply” of units competing for limited employment opportunities, Clarksons Research noted in its latest weekly report, published on Friday, that spot rates have fallen to new record lows. Unlike many other shipping segments, the proportion of LNG carriers trading spot is very small, but nevertheless the dire trading conditions are eroding longer term charter deals too.

The average spot rate assessment for a 174,000 cu m ship fell by 31% to $14,000 a day as of last Friday, while the equivalent rate for a 145,000 cu m steam turbine unit now stands at just $2,500 a day, down 29% week-on-week. Protracted weakness, especially for older steam turbine units, is seeing more vintage gas tankers head for demolition, while many owners are contemplating lay-ups as a record volume of newbuilds readies to leave Asian drydocks.

“General fundamentals are weak,” analysts at broker Braemar noted in a recent report.

Looking at this week, Braemar said it would be monitoring the ongoing cold spell in the US as well as owners’ intention when it comes to laying up their ships or not.

Some analysts do believe that the market is close to bottoming out.

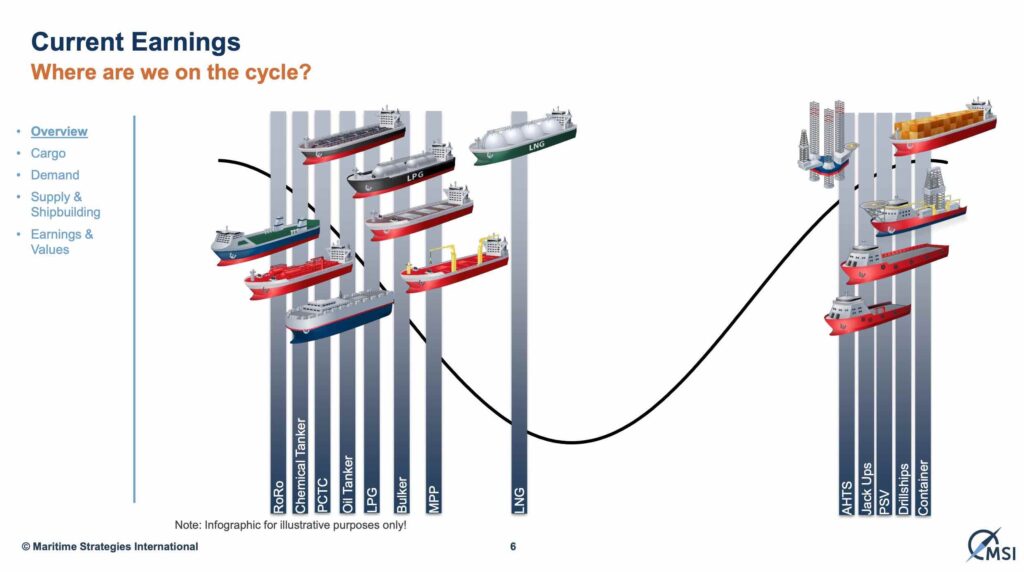

Speaking last week at Marine Money’s London gathering, Dr Adam Kent, who heads up British consultancy Maritime Strategies International, argued that LNG of all shipping segments is the one best poised for an uptick.

Energy News Beat