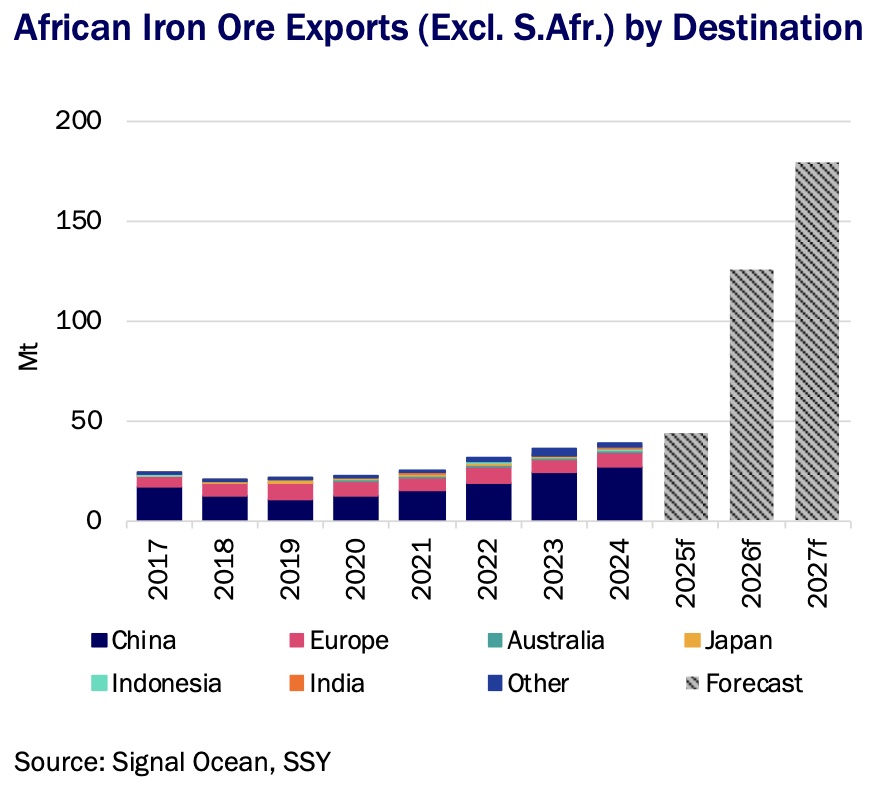

Iron ore exports out of Africa are set to be one of the great growth drivers of global seaborne trades for the rest of the 2020s, new research from broker SSY shows.

Guinea’s Simandou mine alone is set to deliver 60m tonnes of iron ore in its first full year, with production, due to start in 2025, expected to double to 120m tonnes the following year, according to Guinea’s Mines and Geology minister. The project is expected to contribute to 10% of China’s seaborne iron ore demand annually.

The global trade map for iron ore is set for a redraw

Just 200 km away, Ivanhoe Atlantic’s Kon Kweni project is expected to produce up to 5m tonnes of iron ore when its first phase opens next year, with second phase expansion expected to see this figure rise up to 30m tonnes a year.

“Beyond these larger mines, Africa is bustling with smaller yet promising projects,” SSY noted in a monthly markets update, noting Genmin’s Baniaka project and Fortescue’s Belinga project, both in Gabon, as well as ArcelorMittal’s Western Range expansion in Liberia, and Jindal Africa’s project in Namibia.

“As West Africa’s mines muscle out higher-cost producers elsewhere, particularly in Australia, the global trade map for iron ore is set for a redraw,” SSY suggested, something could see a “notable uptick” for capesize tonne-mile demand.

“On the panamax front, Liberia’s newfound iron ore wealth could reshape Europe-bound trade flows, potentially displacing high-cost Canadian exports,” SSY added.

Africa’s growing prominence will be a key plank of discussion during next month’s Iron Ore session at Geneva Dry, the world’s premier commodities shipping conference.

Energy News Beat