A normal cost of capital is a form of much-needed discipline for governments and investors, after years of free money turned their brains to mush.

By Wolf Richter for WOLF STREET.

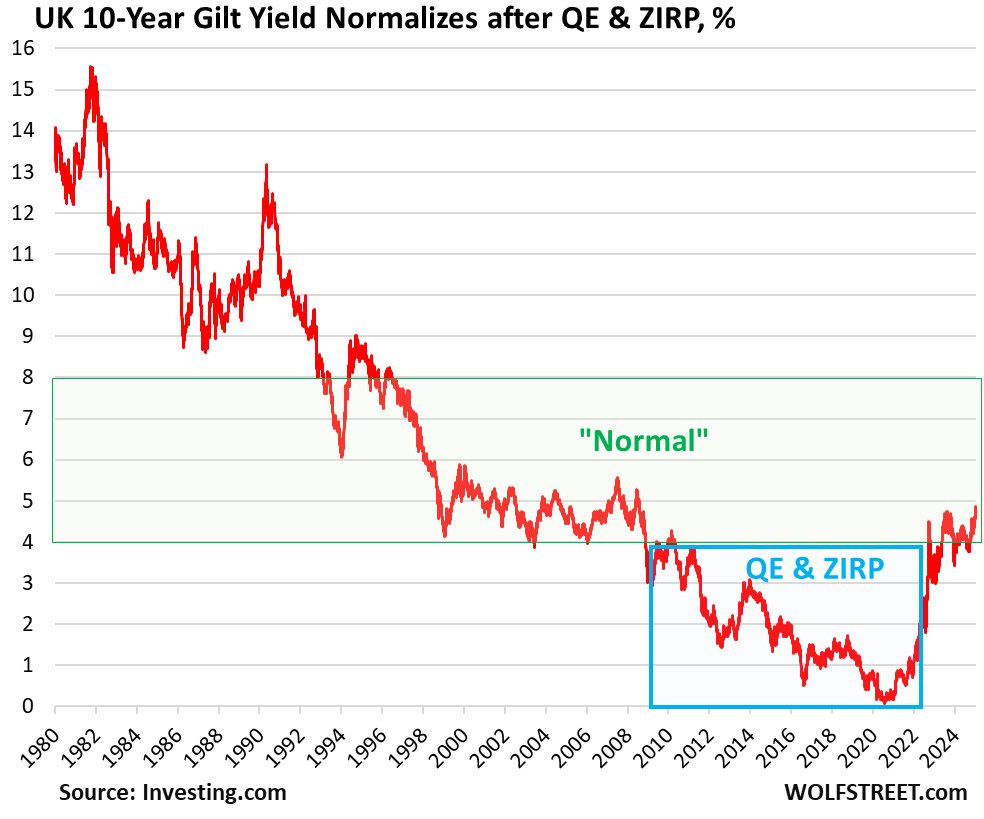

The 10-year yield of UK government securities rose to 4.82% today, the highest since July 2008. The 30-year gilt yield rose at one point today to 5.47%, the highest since 1998, though it backed down to 5.38%. So the UK is a little ahead of US Treasury yields (4.69% and 4.93% respectively).

There was a lot of handwringing in the financial media today and recently about those surging yields, with terms like “gilt market rout” getting into the headlines, and some even seeing a “return of the bond vigilantes,” etc. etc. But wait a minute…

Back on July 29, 2020, the 10-year gilt yield had dropped to an all-time low of 0.09%, back when everyone holding gilts was clamoring for yields to go negative because these holders would benefit from falling yields because bond prices rise when yields fall, and that path into the negative would be the necessary and logical continuation of the 40-year bond bull market and make it an eternal bond bull market, with yields falling ever deeper into the negative, or whatever.

But that final descent from the range of 4-5% in 2008 to near-0% in 2020 was caused by global interest rate repression, with the Bank of England cutting its Bank Rate to near 0% and keeping it there for 14 years (ZIRP), accompanied during some periods by large-scale QE.

Then inflation took off in 2021. The BoE eventually hiked its Bank Rate to 5.25%, and QE flipped to QT. After two careful rate cuts last year, the BoE’s Bank Rate is still 4.75%.

But the thing is, today’s 10-year gilt yield is back in the normal range – normal before ZIRP and QE. It’s actually at the low end of the normal range, and just barely above the BoE’s short-term Bank Rate. It’s at the low end of where it should be in normal times.

The return to normal, after those crazy years, should be seen as a good thing, even if sorting out some of the excesses of those crazy years isn’t always easy.

And a normal cost of capital, provided by the bond market, is a form of much-needed discipline for governments and investors, after years of free money had turned their brains to mush.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Energy News Beat