Tankers

Donald Trump’s so-called maximum pressure on Iran’s oil business is squeezing the number of compliant VLCCs, pushing utilisation for supertankers into the sweet spot 90% territory.

In his first two months back in power, Trump has issued four rounds of sanctions against Iran, including many tankers, a Chinese refinery in China and even a ship that was bound for demolition in Bangladesh.

The VLCC fleet now includes 111 sanctioned tankers, of which 37 were added starting in late 2024 under President Biden and 17 over the past two months under Trump.

“Capacity utilization in the VLCC fleet continues to push closer to 90% and spot rates have responded,” Jefferies noted in a recent report, up from 83% six months ago.

“We think that the sanctions on Iran’s shadow fleet could benefit compliant VLCC as supply tightens,” HSBC stated earlier this month.

“Sanctioned ships may be forced out of rotation, potentially tightening vessel availability,” Braemar forecast, noting how in January and February this year, the 101 tankers sanctioned by the US in 2024 for their involvement in Iranian oil markets had loaded just nine cargoes, all of them Iranian oil.

“Iran could face more challenges selling its oil, even at a steep discount. A reduction in Iranian exports create opportunities for other Middle Eastern or West African exporters to expand sales. Everything else being equal, this will boost employment opportunities for mainstream VLCCs,” Poten & Partners suggested.

In his first term, Trump withdrew the US from the Iran nuclear deal and reimposed a full embargo on Iran’s crude oil exports in 2019. As a result, Iran’s crude oil shipments collapsed from 2.5m barrels per day in the first half of 2018 to 250,000 barrels per day. During the Biden administration, sanctions were not as strictly enforced and Iranian exports gradually recovered.

Dry Bulk

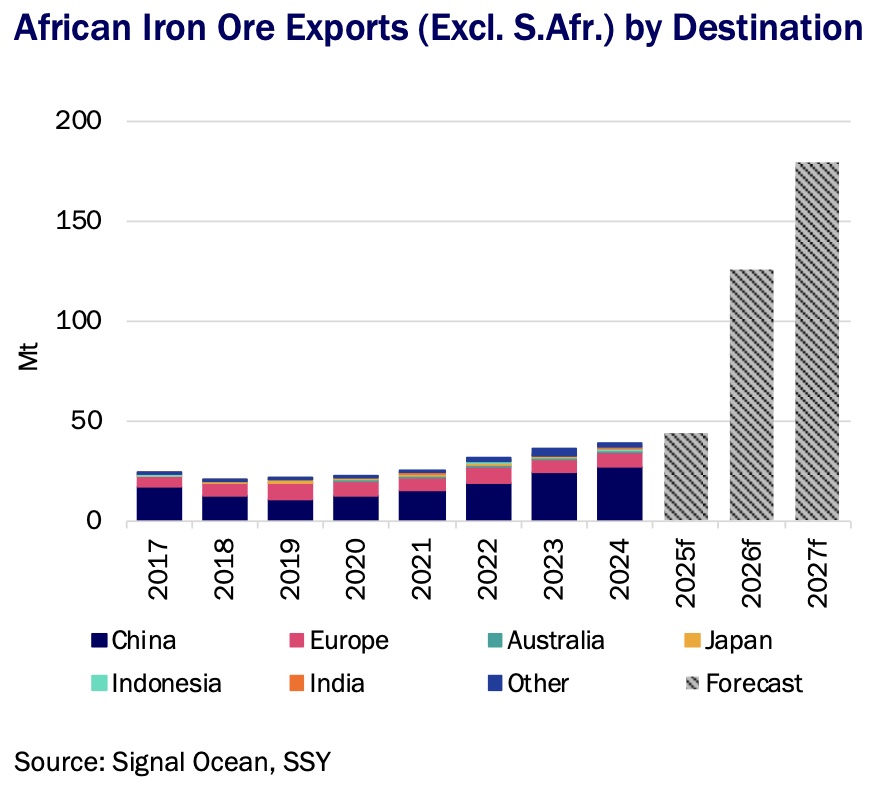

Iron ore exports out of Africa are set to be one of the great growth drivers of global seaborne trades for the rest of the 2020s, new research from broker SSY shows.

Guinea’s Simandou mine alone is set to deliver 60m tonnes of iron ore in its first full year, with production, due to start in 2025, expected to double to 120m tonnes the following year, according to Guinea’s Mines and Geology minister. The project is expected to contribute to 10% of China’s seaborne iron ore demand annually.

Just 200 km away, Ivanhoe Atlantic’s Kon Kweni project is expected to produce up to 5m tonnes of iron ore when its first phase opens next year, with second phase expansion expected to see this figure rise up to 30m tonnes a year.

“Beyond these larger mines, Africa is bustling with smaller yet promising projects,” SSY said in a monthly markets update, noting Genmin’s Baniaka project and Fortescue’s Belinga project, both in Gabon, as well as ArcelorMittal’s Western Range expansion in Liberia, and Jindal Africa’s project in Namibia.

“As West Africa’s mines muscle out higher-cost producers elsewhere, particularly in Australia, the global trade map for iron ore is set for a redraw,” SSY suggested, something could see a “notable uptick” for capesize tonne-mile demand.

“On the panamax front, Liberia’s newfound iron ore wealth could reshape Europe-bound trade flows, potentially displacing high-cost Canadian exports,” SSY added.

Containers

Containership utilisation has slipped below 90% on many of the sector’s biggest tradelanes, while the gap between box freight rates and charter rates hit an all-time high this month.

Data from Linerlytica shows boxship utilisation on three of the four main tradelanes has fallen below 90%. Splash Extra estimates suggest that at today’s freight rates, liners can remain profitable with utilisation at 80%. However, rates have been falling all year long, with a huge volume of newbuilds entering service.

“The unabated demand for ships is keeping the charter market high despite the freight market slump,” Linerlytica noted in a recent weekly report, noting how the charter to freight rate ratio has reached a record high of 289%.

“If cargo demand fails to rebound to drive a freight rate rally, a charter market correction could be due soon,” Linerlytica warned.

“If carriers fail to stabilise freight rates, we could see an increase in surplus tonnage being released into the market,” broker Braemar suggested in a container briefing published yesterday.

Liner shipping profits are forecast to slide by more than 80% this year.

Analysts at Sea-Intelligence have calculated that the container shipping industry made a combined EBIT last year of $60bn, the third-highest figure recorded in the history of the business, and the highest outside the covid era.

One leading container markets analyst, John McCown, who runs New York-based Blue Alpha Capital, is expecting the liner sector to remain in the black this year, albeit with profits sliding to below $10bn.

Container spot rates have been on a constant slide in 2025. The overall Shanghai Containerized Freight Index is now down nearly 50% since the start of the year.

Prices on Asia to North Europe, Asia to the Mediterranean, and on the transpacific to the US west and east coasts are now all lower than at any point in time in 2024, according to data from Drewry.

However, comparing spot rates now to the level seen in mid-December 2023 just before the Red Sea shipping crisis, Asia to North Europe remains up by more than 70%, Asia to the Mediterranean remains up more than 90%, while voyages across the Pacific to both the west and east coasts are still up by more than 40% compared to the lows experienced towards the end of 2023.

Alarm bells are ringing though as Asia to US spot rates have fallen below long term contract rates, something Peter Sand, chief analyst at Xeneta said was another clear sign of a weakening market in 2025.

“The last time spot rates fell below long term rates on the fronthauls from the Far East to US was August 2023 following the massive post-covid market collapse,” Sand said.

The post Analyst Abstract appeared first on Energy News Beat.

Energy News Beat