Bring on the supply. Homebuilders may need to do some serious price cutting to move their inventory.

By Wolf Richter for WOLF STREET.

Big homebuilders cannot sit out this market, they have to do what it takes to build and sell homes to keep their businesses intact and keep their shares from tanking. So they’re building at lower price points, buying down mortgage rates, and throwing in other incentives at a substantial expense to them. Though that may not have been enough.

Some demand has shifted to new houses from existing houses whose sales have plunged to the lowest levels since 1995 because their too-high prices have triggered large-scale demand destruction. But inventories of new houses have been piling up, and then there’s this sales issue in October with spec houses.

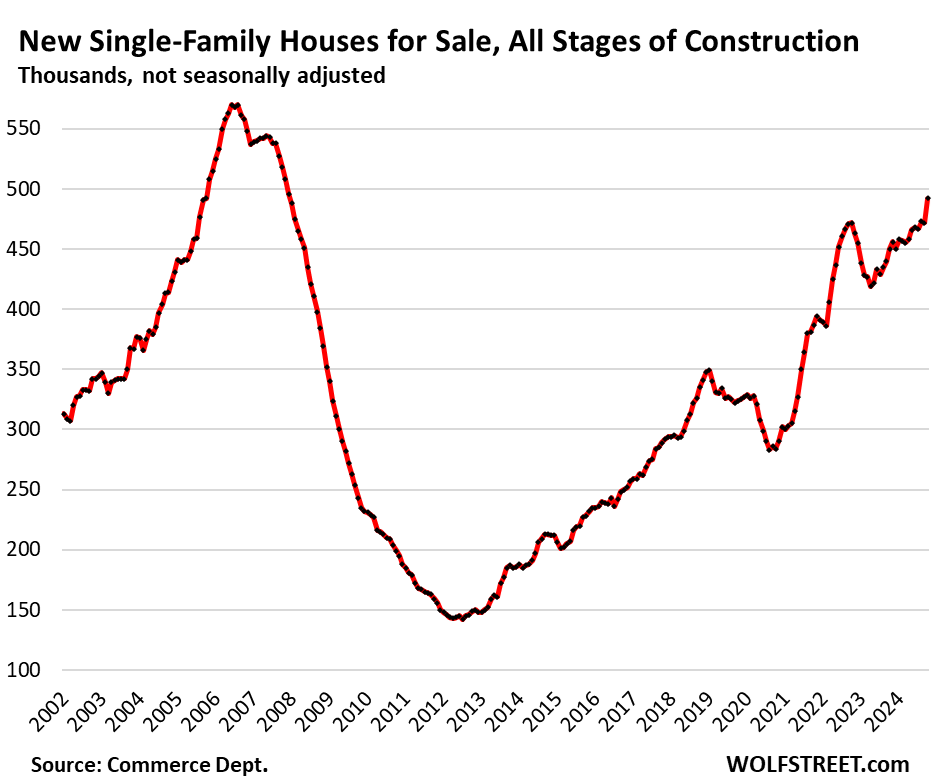

Unsold inventories of new single-family houses at all stages of construction – from not yet started to completed – jumped by 9.3% year-over-year to 492,000 houses, not seasonally adjusted, the highest since December 2007, according to Census Bureau data today. That’s getting on up there. Supply rose to 8.2 months.

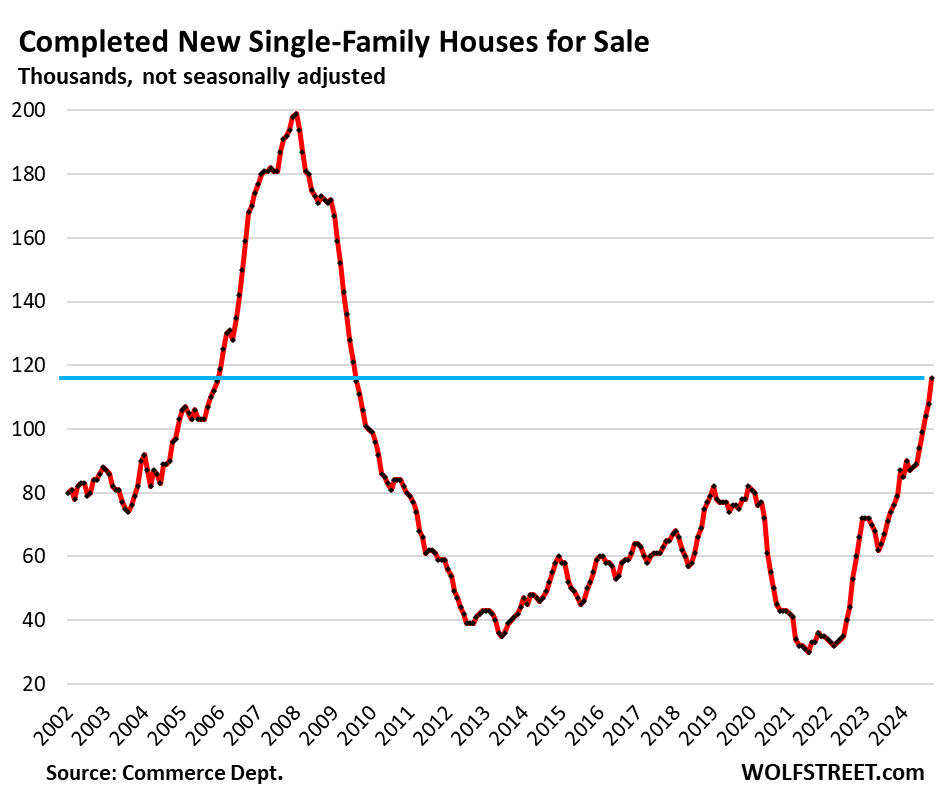

Unsold inventory of completed new houses spiked by 53% year-over-year to 116,000 houses, the highest since July 2009 during the depth of the Housing Bust when homebuilders were trying to survive.

These completed “spec houses” are essentially move-in ready. But builders haven’t found buyers for them yet — and they will need to pretty quickly because they have sunk a lot of capital into these completed houses.

The surge in inventory is a good thing for the housing market. Since builders have tied up a lot of capital in spec houses, they have to sell them quickly. Rising inventory of completed houses encourages builders to lower prices and offer deals, which will help resolve the mindboggling dislocations in prices that we’ve seen across the housing market.

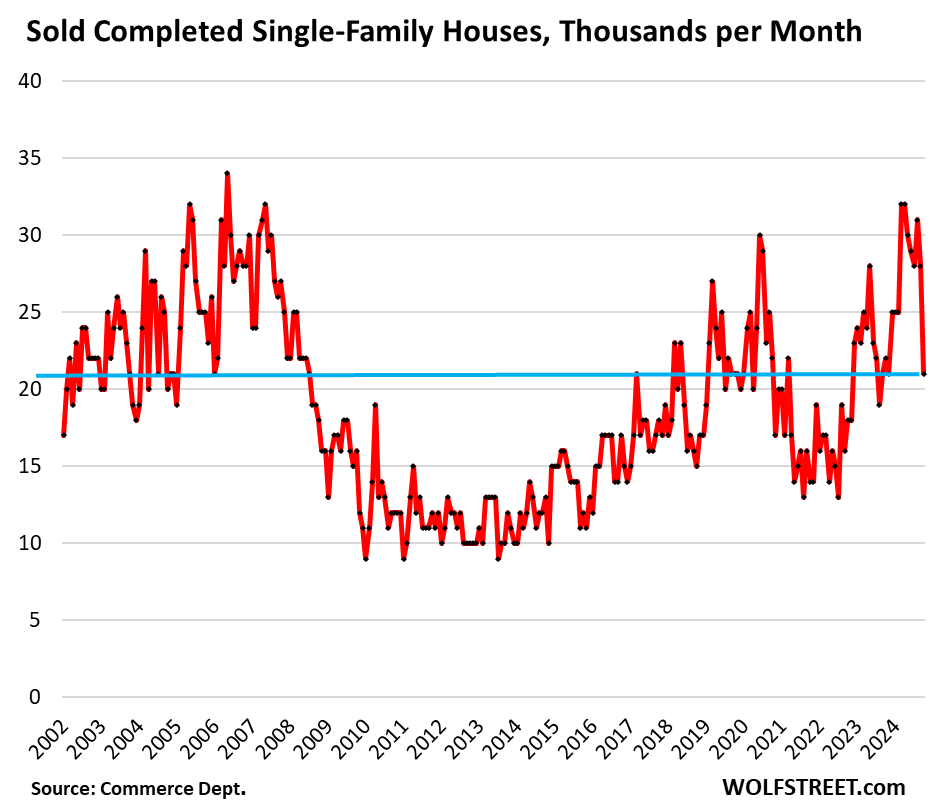

Sales of completed houses plunged 25% month-to-month in October to 21,000 houses, from 28,000 in September, and from 31,000 in August, a huge outlier, perhaps hurricane-related in the crucial South.

If this doesn’t reverse over the next few months, homebuilders will need to start some serious price cutting to get their inventory moving. Year-over-year, sales fell by 4.5%.

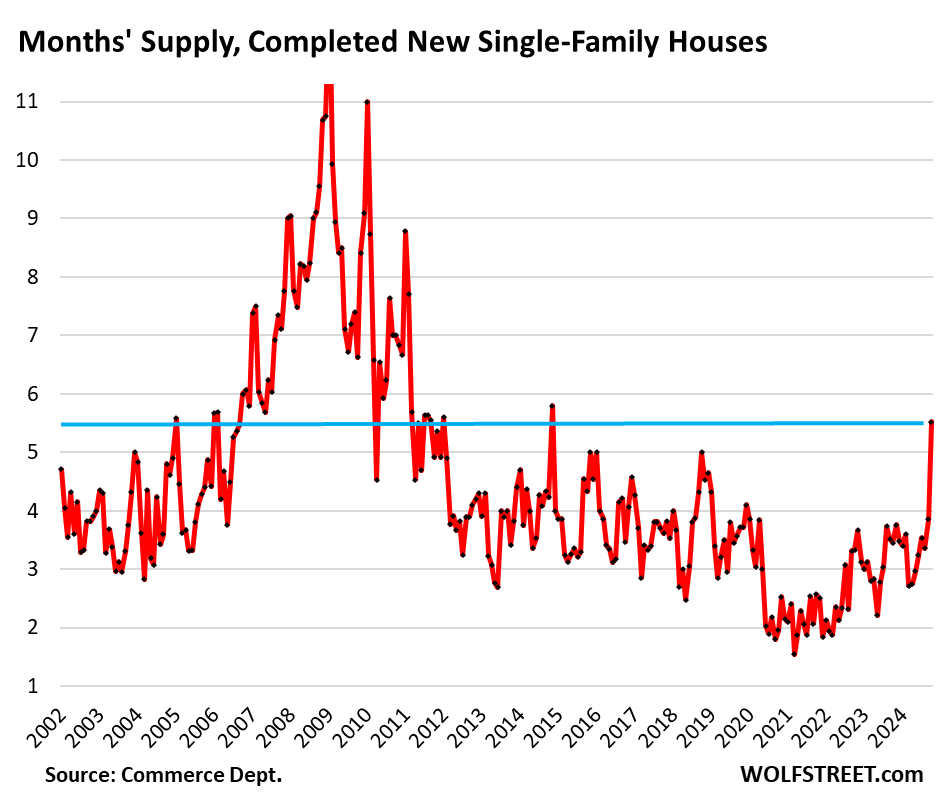

Months’ supply of completed houses spiked to 5.5 months at the current rate of sales, the highest supply since November 2014, and before that since 2012. Supply spiked because sales plunged and inventory surged. This level of supply of spec houses provides a strong motivation for homebuilders to offer deals:

Sales of new single-family houses at all stages of construction, not seasonally adjusted, inched up to about 59,000 in October from 57,000 in September and were up by 7.3% year-over-year, despite the plunge in completed houses. Compared to October 2019, sales were up 18%. So outside of spec houses, sales in October held up.

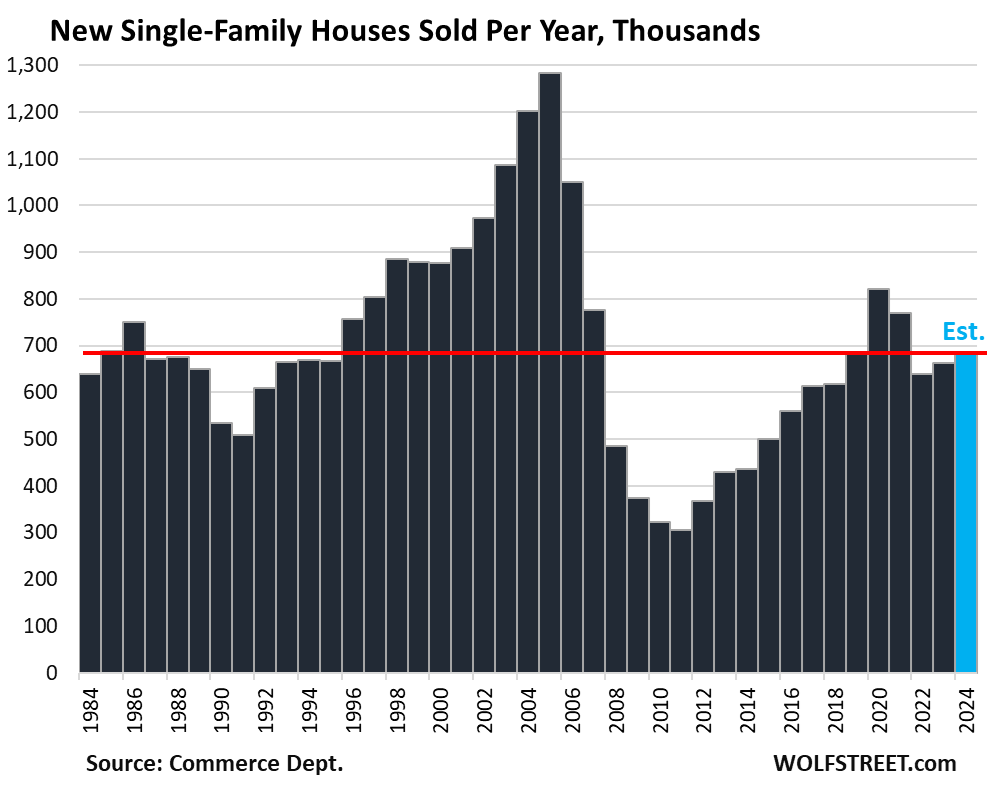

Year-to-date, sales of new houses at all stages of construction rose by 3.3% from the same period in 2023. On this basis, we estimate that sales for the whole year will come in at 686,000 houses, about level with 2019.

Prices, mortgage-rate buydowns, and incentives.

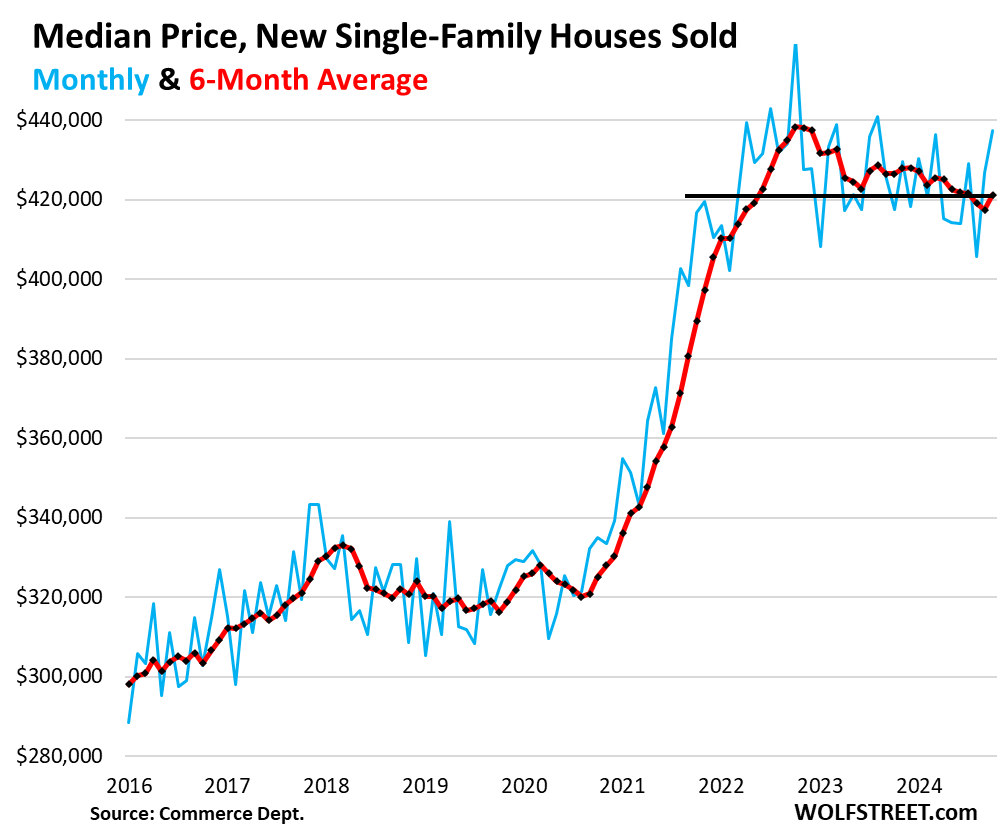

The median contract price of new single-family houses at all stages of construction spikes and plunges month to month in a random non-seasonal way, and it comes with big revisions after the fact (blue in the chart below).

In October, it spiked to $437,300. We had a similar spike in October 2022 to the all-time high of $460,300, after which it plunged.

The six-month average, which irons out much of the month-to-month volatility, ticked up to $421,000, down by 3.9% from its peak in October 2022.

Note that these contract prices do not include the substantial costs to homebuilders of mortgage rate buydowns and other incentives.

For example, Lennar disclosed that in Q3, the costs of its mortgage-rate buydowns and other incentives, such as free upgrades, jumped by 32% year-over-year to $48,100 per house it sold in Q3, which amounted to 10.2% of revenues. So this median price is only a partial measure of the pricing of new houses:

Prices of new houses versus existing houses.

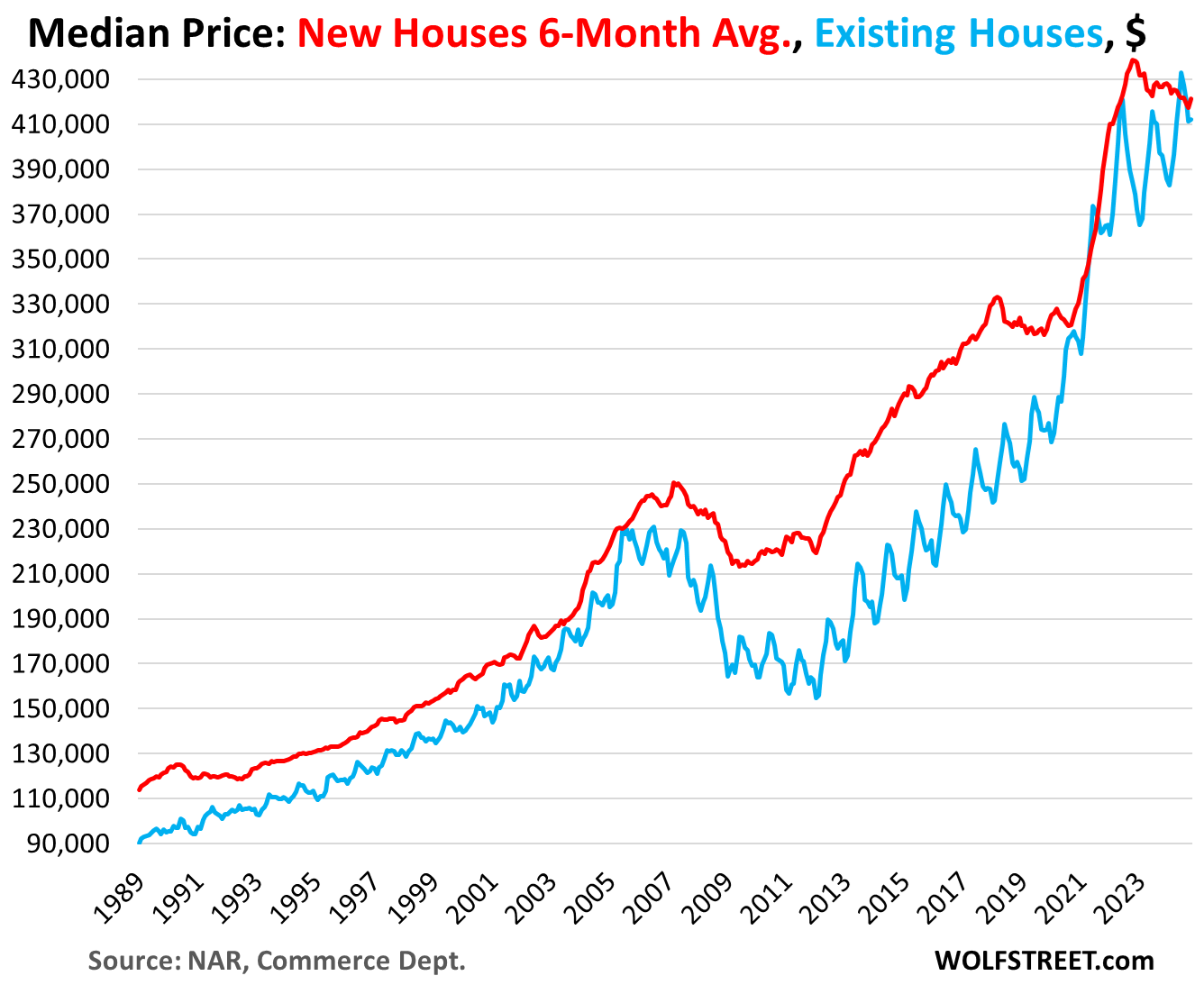

Over the past four decades, the median contract price (six-month average) of new houses exceeded the median price of existing houses nearly all of the time. For most of that time, new houses were between 10% and 30% more expensive than existing houses. This changed in 2021 and then again this year, a very unusual situation.

With mortgage-rate buydowns and other incentives (which are not included here), new houses on a monthly payments basis are out-competing existing houses, which is why a portion of demand has shifted from existing houses to new houses, which is why sales of new houses have largely held up, while sales of existing houses have plunged to levels not seen since 1995.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Energy News Beat